Whole life products: Short pay premium case designs will work across more pay periods since the MEC premiums are increasing. Term products: There is no impact on term products as term premiums are guaranteed and well below the 77A premium levels. The regulation went into effect, and companies need time to get the changes implemented across their product portfolios. Transition rules are not yet clear, and in the absence of more clarity, carriers will likely interpret how quickly it needs to be implemented differently. What does this mean for insurance products?Ĭompanies will need to change the 77A premiums for all products that they currently market. Moving forward, the 77A interest rates will be better aligned with those seen in the market and the guaranteed interest rates of products. What this means is for a specific death benefit, the guideline and MEC premiums will be higher than they are today. The minimum rates will be dynamic after 2021. For 2021, the minimum rates now both move down 2% and use 4% for guideline single premium calculations and 2% for guideline level and MEC calculations. The Consolidated Appropriations Act, 2021 has made a substantial change to the interest rates in IRC Section 7702. (Please see our May POINTS “Interest Rate Interplay” for more information.) So, while these mandated minimum interest rates in IRC Section 7702 have stayed the same, market interest rates have significantly declined, and companies are challenged to generate a return on assets above the high bar set by the tax code.

Today the Federal Funds rate is hovering around the.

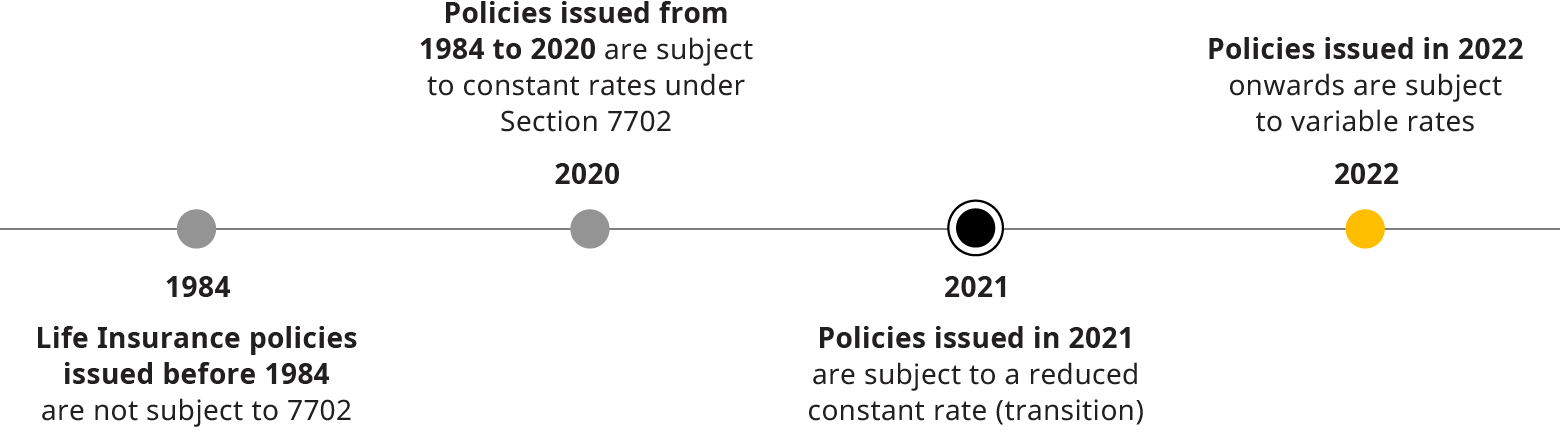

Even through the 90s, guideline premiums and MEC premiums worked well with guaranteed illustrations as interest rates were high enough that those premium levels generally provided a guaranteed premium that endowed a policy on a guaranteed basis. In 1988, the Federal Funds average yield was around 7.5%, and the guaranteed interest rates offered on life insurance products were aligned with the minimum interest assumptions required by 77A. The minimum interest rates (the 4% and 6% above) mandated in the calculations have not changed in those 30+ years. These limits use actuarial calculations for determining the present value of future death benefits using the greater of 6% or the guaranteed interest rate for guideline single premium and the greater of 4% or the guaranteed interest rate for guideline level and MEC (7 pay) calculations.ħ702 was implemented in 19A in 1988. The requirements impose limitations on the premiums paid into the contract and/or the amount of cash that can accumulate relative to the death benefit.

#Irc 7702 code#

Internal Revenue Code (IRC) Section 7702 provides requirements that must be met for an insurance contract to be treated as life insurance for federal tax purposes. What is the background and why was the change made?

0 kommentar(er)

0 kommentar(er)